Dividends are payments you give to shareholders out of your company profits. As a company director, you have to issue a declaration stating how much dividends you give out to shareholders and over what timeframe.

This guide to Dividend Declaration in Singapore will answer all of your questions and walk you through the basics step-by-step, from how to declare your dividends to determining tax treatment for dividend incomes

Generally, a dividend declaration is an event where you announce the dividend payment to shareholders.

According to Section 403 of the Companies Act, you should declare dividends only if there are profits available at the time of declaration. The following clarifies the constitution of your profits:

Most importantly, if you pay dividends when your company has no profit, you may receive a fine of up to US$5,000 or imprisonment up to 12 months.

Also, if your payment of dividends exceeds the company profits, you will hold liability to the creditors.

On the other hand, if your company shareholders receive wrongful dividend distribution, they will hold no liability other than to refund the received amount.

To get a clear insight into dividends in Singapore, simply read our article on the 6 most asked questions about dividends in Singapore.

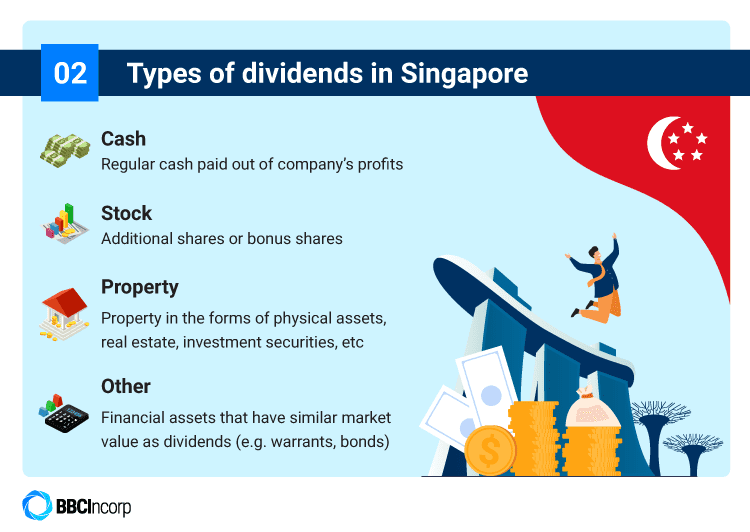

There are several types of dividends you can choose to pay out to your shareholders.

The first one is cash dividends. This is the most common dividend type, which is paid in form of cash to your shareholders.

Apart from paying cash, you can give out stock dividends or bonus shares to your company investors.

Additionally, you may distribute your divided in the form of property dividends. This includes things like physical assets, real estate, investment securities, etc.

In other cases, you can pay your shareholders with financial assets with a similar market value as dividends. These can be warrants, bonds, or shares of subsidiaries.

If you receive property dividends in Singapore, chances are you’ll have to pay property tax. Let’s learn in-depth how Singapore property tax works and how to pay for it.

Normally, declaring final dividends and interim dividends will require different rules.

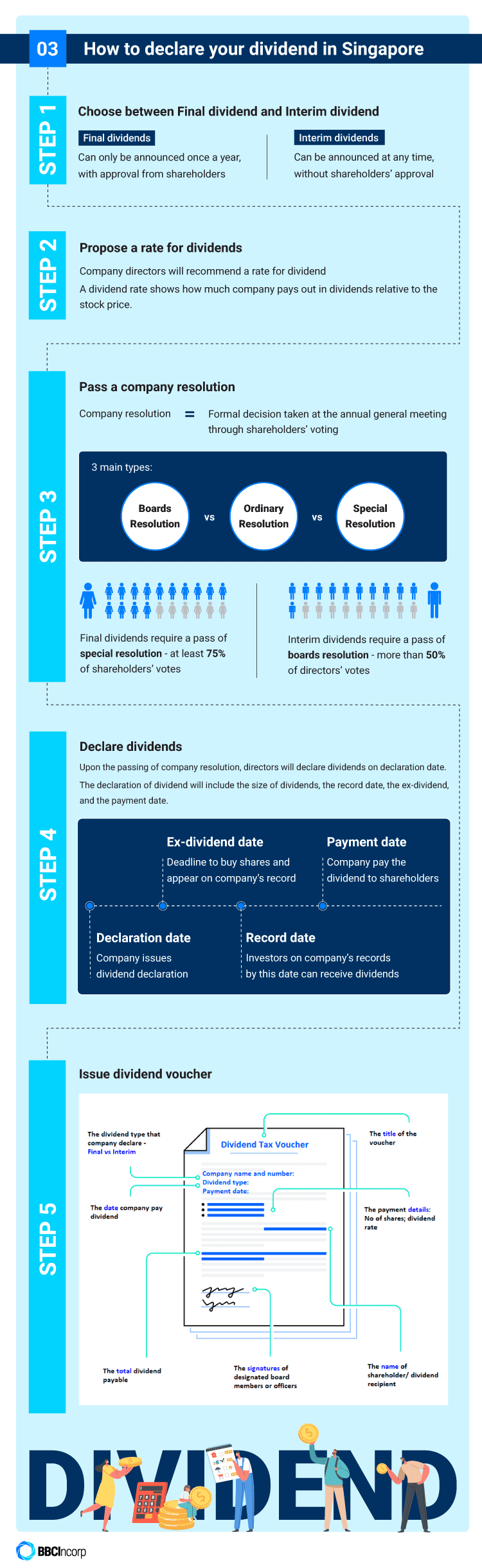

To summarize, you can wrap up the declaration in five simple steps as follow:

Declaring your dividend will involve choosing between a final dividend and an interim dividend.

Final dividends can only be announced once a year, with approval from shareholders.

You can pay out final dividends after publishing your company’s financial statement and confirming your profits for the year.

Interim dividends, on the other hand, can be announced at any time, without shareholders’ approval.

You can payout interim dividends before the annual general meeting (AGM) and the confirmation of your annual profits.

As a company director, you’ll need to recommend a rate for your dividend.

Generally, a dividend rate shows how much your company pays out in dividends relative to the stock price.

Once you propose your dividend rate, you’ll need to pass a company resolution to declare dividends.

Put simply, a company resolution is a formal decision taken at the annual general meeting by voting.

The shareholders can vote on the resolution either by hand or by poll.

There are certain types of resolutions you need to take notice of:

This type of resolution requires a simple majority of votes to pass (i.e. more than 50%), or approval by all of the directors of your company.

Typically, you’ll need to pass a board resolution to declare interim dividends.

You can find an example of board resolutions for dividend declaration in Singapore here.

The shareholder’s resolution can take the form of an ordinary resolution or a special resolution.

An ordinary resolution needs a simple majority at a meeting to pass whereas a special resolution requires at least a 75% majority of votes.

To declare final dividends, you’ll need a pass of special resolution.

For your reference, a special resolution in Singapore will look like this.

Upon the passing of the company resolution, you can officially declare your dividend on declaration date.

Specifically, your declaration will include the size of dividends and dividend dates such as the record date, the ex-dividend, and the payment date.

List of dividend dates

For example, your company declared a dividend on November 10th, 2021 (declaration date) of US$0.40 per share (size of dividend) payable on December 20, 2021 (payment date) to shareholders of record as of November 30, 2020 (record date) .

If you choose to declare final dividends, you cannot revoke or cancel them in any way. But if you declare interim dividends, you can cancel or modify them without legal entanglement.

However, it is always recommended that you stick to the approved declaration to not upset your shareholders.

After the declaration of the dividend, make sure you issue dividend vouchers to your shareholders.

Essentially, it is a dividend receipt that records all details of dividend payment, including the name of shareholders, date of issue, number of shares, total dividend paid, and more.

Your company’s dividend voucher will look something like this.

Overall, the dividend distributions by a Singapore resident company are tax-free. This means that neither your company nor the shareholders will have to pay tax on the dividend payments.

However, there are some cases where special tax treatments are applied.

Typically, non-taxable dividends include:

On the flip note, taxable Singapore dividends include:

If you want to see how taxes could potentially affect your business in Singapore, simply check out our overview of taxation in Singapore.

Once you declare your dividend payment, it will appear on your liability account. In other words, you are owning debt to your shareholders until the payment.

The amount of your liability will depend mostly on the value of declared dividends.

After you pay out dividends to shareholders, your liability account will disappear, and the cash account will be credited by a similar amount.

At this point, you’ve gained a basic understanding of dividend declaration in Singapore, as well as the procedure you’ll need to follow.

We’ve summarized a list of key points to help you organize your thoughts better:

If you want to learn more about running a business in Singapore, get in touch with one of our friendly consultants via service@bbcincorp.com and we’ll help you with any concerns you may have.

No, a dividend is not an expense for tax purposes, but a distribution of your company’s retained earnings.

As such, your company does not receive a tax deduction or tax shield from the dividend payment.

If you are a director or an employee of the company, you should always receive your salary.

If you depend on dividend payment, you may not receive a sufficient source of income if the company has made no profits or suffered a loss.

Apart from a dividend voucher, you will need the following documents to declare dividends in Singapore:

Reinvested dividends are subject to the same tax rules that apply to dividends you receive, so they are taxable.

The normal frequency is four times per year on a quarterly basis. However, you can pay dividends twice a year, once a year, or even monthly.

There is no specific in this matter. In fact, you can set your own policies regarding dividend payments.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.